It’s important to note that not all rising wedges lead to a price reversal, so traders should also use other technical analysis tools to confirm the pattern before making any trading decisions. Traders can place a short position or exit any long positions they may have.

This is considered a sell signal and could indicate that the price is about to reverse. Traders can use the rising wedge pattern to make trading decisions by watching for a break below the lower trendline. Traders should also look for other technical indicators to confirm the pattern, such as a divergence in the Relative Strength Index (RSI) or a bearish crossover in the Moving Average Convergence Divergence (MACD).

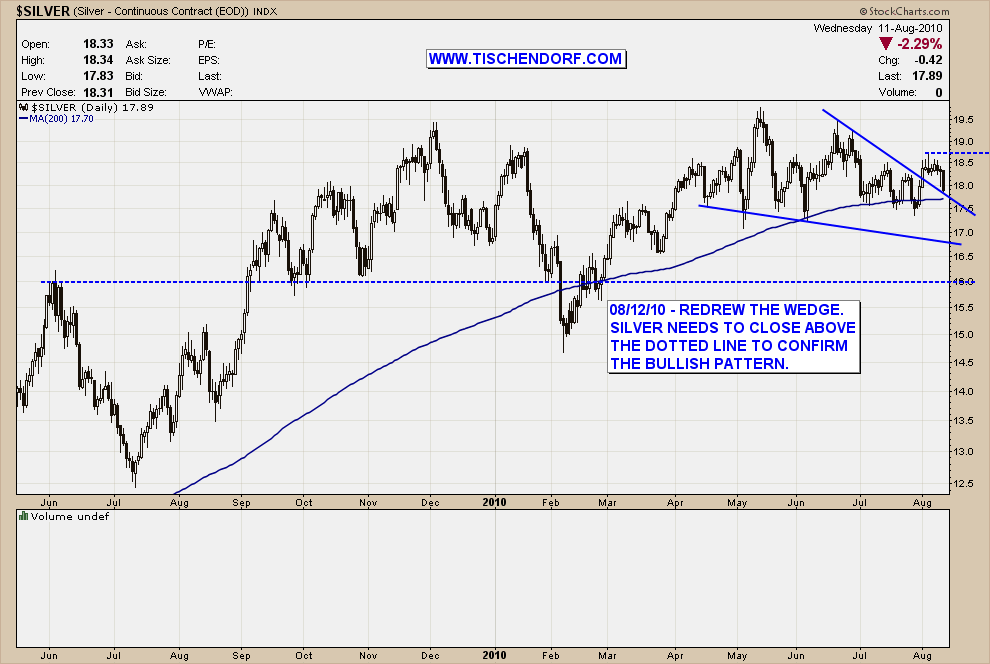

The pattern is confirmed when the price breaks below the lower trendline. The upper trendline should be steeper than the lower trendline, and the two lines should converge at an apex.

#Bullish wedge pattern series#

To recognize a rising wedge pattern, traders should look for a series of higher highs and higher lows in the price action. It is important to note that not all rising wedges lead to a price reversal, but they do indicate a potential shift in market direction that traders should be aware of.īest Broker In India Recognizing a Rising Wedge Pattern The rising wedge pattern is considered a bearish reversal pattern because it often signals that the uptrend is losing momentum and that a price reversal may be imminent. The two lines converge to create a wedge shape. The upper trendline is drawn by connecting the highs, and the lower trendline is drawn by connecting the lows. The pattern is created by connecting the highs and lows of the price action with trendlines. This results in a wedge-like shape that slopes upward as the price continues to rise. A rising wedge pattern is a price pattern that occurs when the price of an asset is moving higher, but the rate of ascent is slowing down.

0 kommentar(er)

0 kommentar(er)